August 2022 Newsletter

Winter floods serve as a timely reminder.

As we go to press there is yet another round of severe flooding across New Zealand. This time Nelson and Northland have been hit, only a few weeks after Dunedin was caught in a massive deluge. It will be devasting for those homeowners affected, but it also serves as a reminder that we need to check the sum our most valuable assets are insured for – i.e. make sure you have the right cover in place!

Please check your insurance renewal documents.

When receiving your renewal documents in the post, please check the sum insureds for your house, contents and vehicles to make sure that you are insured for an adequate amount for replacement value.

AMP/Vero House Cover – Look at the sum insured.

With increased building costs it is advisable to look at the sum insured for your house at renewal. We will remind you at policy renewal if the Cordell Calculator has not been completed within the past 3 years.

You can update the sum insured at any time. If you feel you may be underinsured, please complete the Cordell Calculator whenever it is convenient and send the copy to us for an updated quote.

Sum Extra gives you full replacement or repair if the home is damaged by fire even if the cost exceeds your sum insured or an additional 10% in a natural disaster.

Home Contents Sum Insured Calculator

This calculator estimates the replacement cost of your home contents using information supplied by Sum Insured Pty Ltd, New Zealand and Australia's leading provider of building contents cost information.

Based on general information about your home the calculator will provide an estimated contents value and summary that you can further edit for a more accurate result if you wish.

Just enter your address to find out your estimated home contents replacement cost.

If your details need to be amended, simply answer a few quick questions and a new contents sum insured will be automatically calculated.

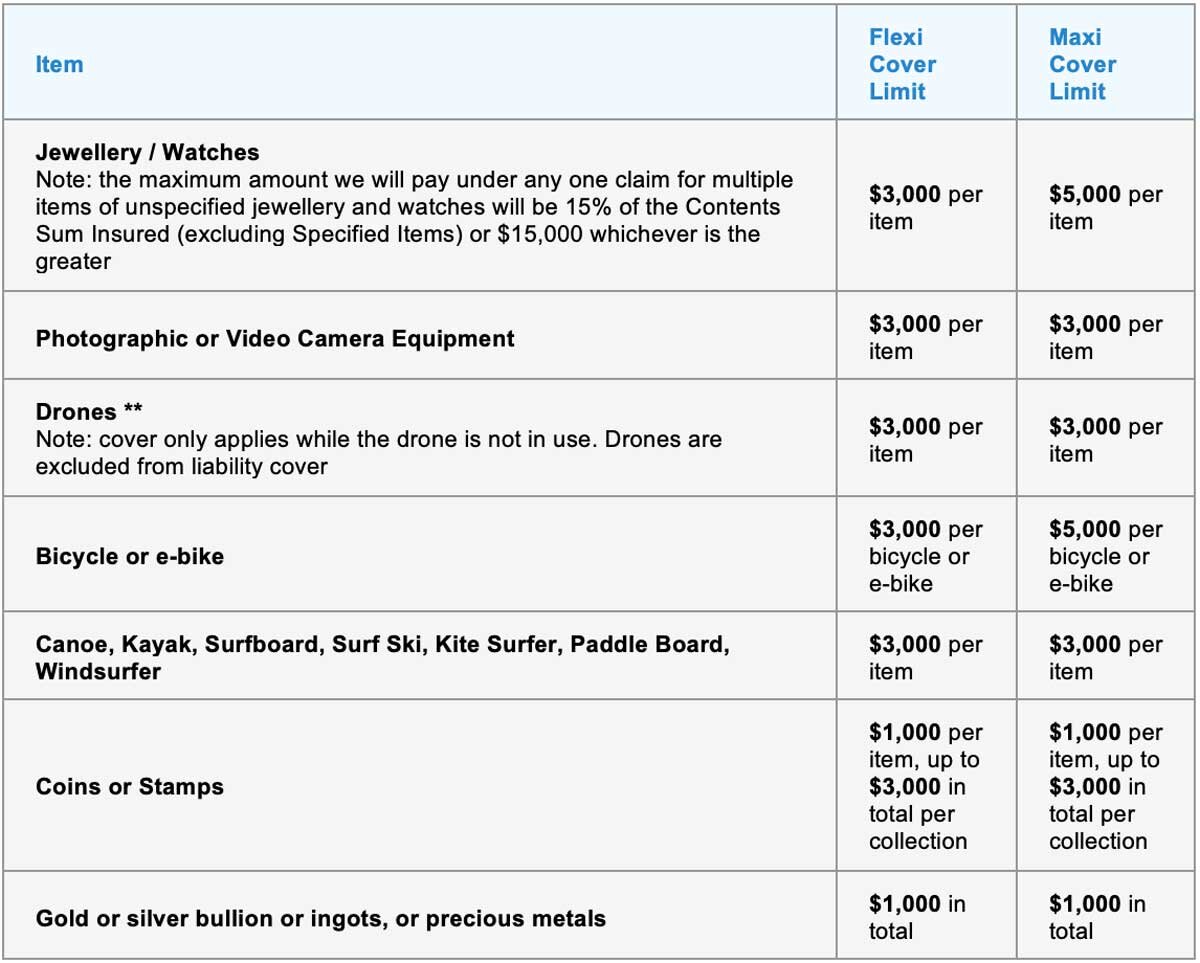

AMP/Vero Contents Cover – Flexi vs Maxi

We have included limits on the various contents policies, if any of your items exceed these limits, then they should be added as a specified item to your policy to ensure they are adequately covered.

Did you know if your contents value is under $40,000 you only qualify to a flexi policy.

A flexi policy is a basic policy and may not give you the full protection you need – ask the team about the difference between Flexi and Maxi today.

AMP/Vero Meth Contamination Cover for Landlords.

To all our clients that have rental properties with landlord extension cover, please note there is a contamination trigger limit of 15μg/100cm². Therefore, any claim for meth contamination under this limit is not claimable. This is the same limit that Kianga Ora and the Tenancy Tribunal works to.

The Government is increasing levies.

All insurance companies collect levies on behalf of the Government, which are used to fund public services such as the Earthquake Commission (EQC) and Fire and Emergency services. These levies are included in the cost of your insurance and these get passed on to the Government.

Changes to EQ Cover

EQ Cover for domestic buildings will increase from $150,000 to $300,000 (plus. GST). In the event of a natural disaster, insurers will cover losses above $300,000 (up to the policy sum insured) if required.

EQC levy will increase to $480, up from $300 (plus GST).

The change will take effect for existing policies as they renew from 1 October 2022 and all new policies issued from this date.

Insurance Claims

What you can do to assist:

Make sure claim forms are fully completed and ensure that all information, including bank account details are sent with the claim form.

Advise us of the repairer details at the time of lodgement as it's more efficient if we can action the claim once and well.

A picture is worth 1000 words - if possible, make sure to send photos of damages for property claims.

Please provide any proof of purchase you have and also replacement quotes

NIB – Health Insurance Provider

We encourage all our clients who have health insurance with NIB to register on the website as this enables a quick, easy and hassle-free way to communicate with NIB to view policy details, lodge claims, request pre-approval, track your claims & view claims history.

Is your business ‘Cyber Crime’ protected?

Unfortunately, cyberattacks are a real and growing threat. Last year there were over 8,831 cyberattacks reported to CERT NZ, costing companies around $16.8m. And it’s not just big organisations that are at risk. Small and medium-sized businesses are vulnerable too.

Cyber insurance is designed for New Zealand businesses, to help mitigate the costs involved with recovery after a cyber-related security or privacy event. Cover includes:

Forensic investigation costs

Data and/or software restoration

Liability

Legal costs

Crisis management

Business interruption

Direct financial losses

Intellectual property

Who should consider this product?

Any organisation could be vulnerable to a data breach or loss of services, particularly if they hold the following:

Personally Identifiable Information (PII)

Protected Health Information (PHI)

Payment Card Information (PCI)

If you’d like to find out more, please get in touch.

Reminders

Vehicle claim excess

Just a reminder to all our clients where the excess applies:

Not at fault accident, third party has admitted liability, and you have all third-party details – No excess applies

Damage to third-party but no damage to your vehicle – No excess applies

At-fault accident – Excess applies

Damage while parked and no third-party details - Excess applies

Accident but third-party disputes liability - Excess applies

Damage and no third party involved – Excess applies

We would like to also remind clients that AMP Life is now known as Resolution Life. Resolution Life is a global manager of in-force life insurance businesses who provide policyholders with peace of mind that their insurance is in safe and trusted hands for the long term. Since 2003, various Resolution entities have committed over US$16 billion of equity in the acquisition, reinsurance, consolidation, and management of 28 life insurance companies. Together, these companies have served the needs of over 10 million policyholders while managing over US$320 billion of assets. By joining Resolution Life, they are now part of a business focused on existing customers rather than seeking to attract new ones.